HEG posted another strong quarterly result along with improved utilisation guidance and expectation of higher contract prices in the upcoming contract cycle. Higher availability of needle coke for the near term and Supreme Court relief on petcoke ban adds to earnings visibility. However, volume growth expectations in the medium term remains limited, but favourable end-market opportunities are expected to provide pricing support.

In Q2 FY19, HEG witnessed another strong quarter, with sales up 13 percent sequentially, aided by higher volumes (4 percent quarter-on-quarter), currency benefit and sustenance of higher product prices.

It realised blended graphite electrodes sales of around $14,000-15,000 per tonne (similar to Q1 FY19). It is noteworthy that 80 percent revenue accrues from better grade electrode (ultra-high power) used in electric arc furnaces. Exports contribute 70 percent of revenue and commands higher realisations.

In the quarter under review, capacity utilisation improved to 85 percent from 82 percent in Q1. Raw material prices surged 50 percent sequentially as new contracts for needle coke kicks in. However, inventory gains resulted in higher gross margin. Higher operating leverage led to earnings before interest, tax, depreciation and amortisation (EBITDA) per tonne of 11 percent QoQ and more than seven times jump on a year-on-year (YoY) basis.

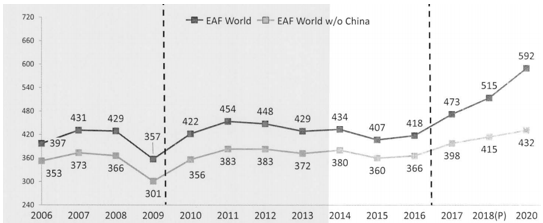

EAF world production (million tonne)

Source: HEG,World Steel Association

Source: HEG,World Steel Association

Within China, EAFs are increasingly replacing induction furnaces/blast furnaces, thus acting as another important support for graphite electrode prices. Steel production in China through the EAF route is expected to increase by three times in 2020 to 160 MT (20 percent of total) versus 52 MT (5 percent) in 2016.

Capacity utilisation guidance

The management said improved availability of needle coke in H2 FY19 is because of capacity debottlenecking (50-60,000 tonne) by ConocoPhillips. HEG expects around 90 percent capacity utilisation in H2. In the longer term, the company’s tentative plan for a 25 percent increase in graphite electrode capacity hangs on availability of new supply of needle coke

in future.

The management is hopeful of further improvement in product prices in the new contract cycle (January-March CY19 quarter), for which contracts would be signed in the next 4-5 weeks.

Waning risk factors

With the US allowing India to continue importing oil from Iran, risk of emerging Iran sanction extending to other industrial products has also waned for the time being. It may be noted that HEG has a revenue exposure of 6-7 percent from Iran.

Risk with respect to petcoke imports has been eliminated. The Supreme Court in its September order has included graphite electrode industry as one of the five industries where petcoke imports are allowed as a feedstock.

Going forward

We remain constructive on the stock (4.6 times FY20 estimate) given the end-market opportunities, preference for the EAF route for steel manufacturing and China’s supply-side reforms. In the short term, additional earnings accretion is on account of the improved availability of needle coke. In the longer term, given the long gestation period for greenfield projects, cash flow visibility is expected.

SYDNEY (Reuters) - Asian shares and U.S. stock futures slipped on Tuesday amid signs of pessimism about world...

HEG posted another strong quarterly result along with improved utilisation guidance and expectation of higher contract prices in...

We now see that the demand for steel is getting into the form of proper enquiries, which are...